Business-to-business credit application forms are crucial for facilitating credit extensions between companies. They establish trust and ensure smooth transactions by verifying a company’s creditworthiness and financial stability.

1.1 Importance of Credit Applications in B2B Transactions

Credit applications are essential in B2B transactions as they enable suppliers to assess a buyer’s creditworthiness before extending credit. By verifying financial stability and legitimacy, these forms reduce risks and ensure timely payments. They also establish a formal agreement, protecting both parties and fostering trust. A well-structured credit application helps suppliers avoid bad debt and ensures smooth, professional relationships. It’s a critical tool for maintaining financial security and promoting mutually beneficial business partnerships.

1.2 Overview of the Credit Application Process

The credit application process involves several structured steps to evaluate a business’s eligibility for credit. It begins with the submission of a completed application form, which includes detailed company information, financial data, and trade references. Suppliers then review the application, verifying the provided details and assessing creditworthiness. This may involve checking credit history, financial statements, and references from other suppliers. Once the evaluation is complete, the supplier makes a decision to approve, deny, or request additional information. The process ensures a thorough assessment, balancing the supplier’s risk exposure with the buyer’s need for flexible payment terms. Efficiency and accuracy are key to maintaining a smooth workflow.

Key Components of a B2B Credit Application Form

A B2B credit application form typically includes company details, financial information, trade references, and credit terms. These components ensure a comprehensive evaluation of a business’s creditworthiness.

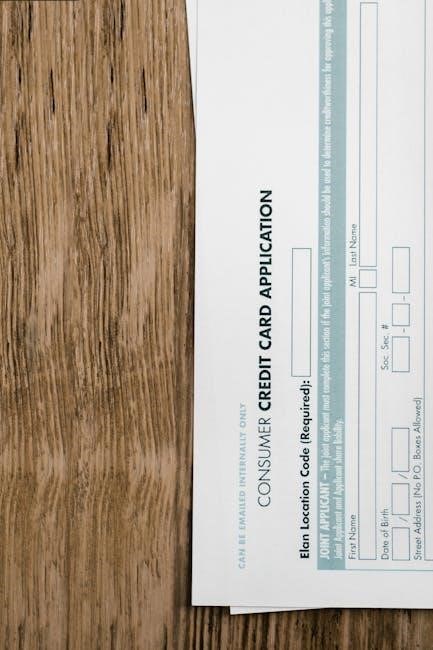

2.1 Company Information and Business Details

This section is fundamental for assessing a company’s credibility and operational legitimacy. It typically includes the business name, physical and mailing addresses, contact information, and tax identification numbers. Additionally, details about the company’s legal structure, such as LLC, corporation, or partnership, are often required. The form may also ask for the names and titles of key personnel, including owners, directors, or authorized signatories. This information helps suppliers verify the business’s identity and legitimacy, ensuring compliance with legal and financial standards. Accurate and up-to-date company details are essential for building trust and facilitating smooth credit evaluations.

2.2 Financial Information and Credit History

Financial information and credit history are critical components of a B2B credit application form. This section typically includes details about the company’s financial stability, such as income statements, balance sheets, and cash flow statements. Suppliers may also request access to credit reports from agencies like Dun & Bradstreet to assess the company’s creditworthiness. Additionally, the form may ask for information about outstanding debts, payment history with other suppliers, and any bankruptcies or legal financial issues. This data helps suppliers evaluate the risk of extending credit and ensures that the business can meet its financial obligations. Accurate financial disclosure is essential for building trust and securing favorable credit terms.

2.3 Trade References and Supplier Details

Trade references and supplier details are essential for verifying a company’s credibility and payment history. This section typically requires the applicant to list previous suppliers or business partners, including their contact information. Suppliers use these references to assess the applicant’s reliability and financial responsibility. Providing accurate and reputable trade references strengthens the applicant’s case for credit approval. Additionally, this section may ask for details about the nature of the relationship with each supplier, such as the length of the business partnership and the types of products or services involved. This information helps suppliers evaluate the applicant’s track record of timely payments and ethical business practices.

2.4 Terms and Conditions of Credit

The terms and conditions of credit outline the agreed-upon rules for extending credit to a business. This section specifies payment terms, interest rates, and penalties for late payments. It also clarifies the credit limit, invoicing procedures, and the duration of the credit agreement. Both the supplier and the applicant must agree to these terms to ensure a mutually beneficial arrangement. Clearly defined terms help prevent disputes and establish a framework for resolving issues. By signing the form, both parties acknowledge their commitment to adhering to the outlined credit policies, ensuring transparency and accountability throughout the business relationship.

Benefits of Using a B2B Credit Application Form

Using a B2B credit application form enhances credibility, streamlines transactions, and minimizes financial risks. It ensures transparency, builds trust, and provides a clear framework for credit agreements.

3.1 Building Trust and Credibility

A B2B credit application form is essential for establishing trust and credibility between businesses. It ensures transparency by requiring detailed company information, financial history, and trade references, which helps suppliers assess the buyer’s reliability.

By providing accurate and complete data, businesses demonstrate their commitment to accountability and professionalism. This mutual trust fosters long-term partnerships and ensures smooth transactions, benefiting both suppliers and buyers in the B2B ecosystem.

3.2 Streamlining the Credit Approval Process

A B2B credit application form simplifies the approval process by providing a structured format for gathering essential information. This ensures that all necessary details are collected upfront, reducing delays and misunderstandings.

Standardized forms allow suppliers to quickly assess a company’s creditworthiness, enabling faster decision-making. Automated systems can further streamline the process by verifying data in real-time, minimizing manual reviews and accelerating approval timelines.

3.3 Reducing Financial Risks

B2B credit application forms play a critical role in minimizing financial risks for suppliers. By requiring detailed financial information, credit history, and trade references, these forms help suppliers assess a company’s ability to meet payment obligations.

This reduces the likelihood of late payments or defaults, protecting the supplier’s cash flow. Additionally, the inclusion of credit terms and conditions ensures both parties are aligned, further mitigating potential disputes or financial losses. Overall, a well-structured credit application form acts as a safeguard, enabling informed decision-making and fostering a secure business relationship.

Best Practices for Completing a B2B Credit Application

Ensure accuracy and completeness in all provided information, review terms carefully, and submit required documents to facilitate a smooth and reliable credit approval process.

4.1 Providing Accurate and Complete Information

Accurate and complete information is essential for a seamless B2B credit application process. Ensure all details, such as company history, financial data, and trade references, are up-to-date and verifiable. Errors or omissions can lead to delays or rejection. Double-check every entry, including contact details and banking information, to avoid discrepancies. Providing transparent and factual data builds credibility and trust with suppliers or creditors. Incomplete applications may result in additional requests for clarification, slowing down the approval process. Regularly update your business records to ensure consistency and accuracy when filling out credit forms. Attention to detail is critical to maintaining professional relationships and securing favorable credit terms.

4.2 Understanding Credit Terms and Conditions

Understanding credit terms and conditions is vital for a successful B2B credit application. Reviewing and comprehending the agreement ensures clarity on payment schedules, interest rates, and late penalties. Misinterpreting terms can lead to disputes or financial strain. Carefully analyze the repayment structure, grace periods, and any hidden fees. Ensure alignment with your business’s financial capacity and cash flow projections. Clear communication with creditors can resolve ambiguities and prevent future misunderstandings. Understanding these terms fosters a transparent and mutually beneficial relationship, safeguarding both parties’ interests. It also helps in negotiating terms that suit your business needs, ensuring a smooth and sustainable credit arrangement.

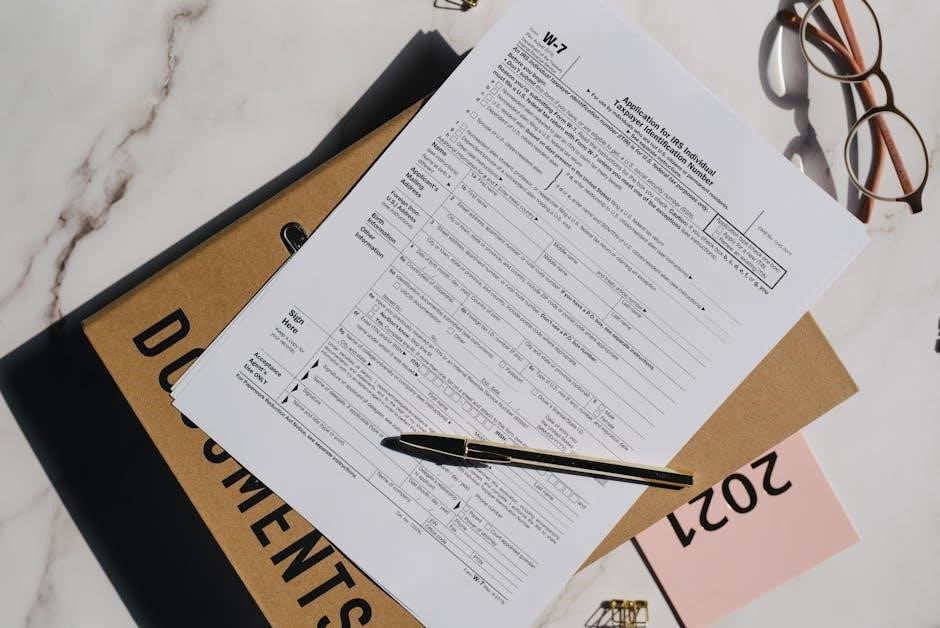

4.3 Submitting Supporting Documents

Submitting supporting documents is essential for a seamless credit application process. Ensure all required financial statements, bank statements, and trade references are included. These documents verify your business’s credibility and financial health. Provide accurate and up-to-date information to avoid delays. Include tax returns, balance sheets, and profit-and-loss statements to demonstrate stability. Trade references from trusted suppliers or clients can strengthen your application. Organize documents clearly and ensure they are legible. Double-check for completeness before submission. This step builds trust with creditors and accelerates the approval process. Proper documentation also reduces the risk of misunderstandings or rejected applications, ensuring a smooth experience for both parties involved.

Legal Considerations for B2B Credit Applications

Compliance with financial regulations and data protection laws is critical. Ensure credit applications adhere to privacy standards like GDPR to safeguard sensitive business information and maintain legal integrity.

5.1 Compliance with Financial Regulations

Compliance with financial regulations is essential for B2B credit applications to ensure legality and avoid penalties. Businesses must adhere to anti-money laundering (AML) and know-your-customer (KYC) laws, which require verifying a company’s identity and legitimacy. Additionally, data protection laws like GDPR and CCPA mandate the secure handling of sensitive information. Credit providers must also comply with the Fair Credit Reporting Act (FCRA) when accessing credit histories. Failure to meet these standards can result in legal action, fines, and reputational damage. Regular audits and updated policies help maintain compliance and build trust with business partners.

5.2 Protecting Confidential Business Information

Protecting confidential business information is critical when handling B2B credit applications. Sensitive data, such as financial records and trade secrets, must be safeguarded to prevent unauthorized access or misuse. Employing encryption, secure databases, and restricted access policies ensures confidentiality; Additionally, businesses should implement non-disclosure agreements (NDAs) with employees and third-party vendors. Regular audits and compliance with data protection laws, like GDPR and CCPA, further enhance security. Breaches can lead to legal consequences and loss of trust, making robust protective measures essential for maintaining credibility and fostering long-term business relationships while ensuring compliance with privacy regulations.

Digital Tools for Managing B2B Credit Applications

Digital tools streamline B2B credit application processes, enhancing efficiency and reducing errors. Online platforms and automated systems enable faster approvals and improved accuracy, ensuring seamless operations and better decision-making.

6.1 Online Application Platforms

Online application platforms simplify the B2B credit application process by providing a centralized digital interface. These platforms allow businesses to submit credit requests securely, reducing manual paperwork and errors. Features like real-time data entry, automated validation, and instant notifications enhance efficiency. Many platforms integrate with existing financial systems, enabling seamless credit checks and approvals. Advanced security measures, such as encryption, protect sensitive business information. Customizable forms and workflows cater to specific organizational needs, ensuring a tailored experience. Accessible from anywhere, these platforms facilitate faster decision-making and improve collaboration between businesses. They also provide a transparent record of all transactions, fostering accountability and trust. This digital approach streamlines operations and reduces delays.

6.2 Automated Credit Checking Systems

Automated credit checking systems enhance the efficiency of B2B credit applications by enabling real-time financial data analysis. These systems integrate with online platforms, verifying a company’s credit history, payment patterns, and financial health instantly. Advanced algorithms assess risk levels, reducing manual effort and potential errors. Businesses can set customized criteria for credit approvals, ensuring consistent decision-making. Automated systems also generate detailed reports, providing insights into creditworthiness. This streamlined process accelerates approval times, improving relationships between suppliers and buyers. By minimizing human intervention, these systems reduce delays and enhance overall operational efficiency, making them indispensable for modern B2B credit management and maintaining seamless trade interactions.